Ivanice da Silva Santos1, Natanael Lucena Ferreira2, Vivian Soraia da Silva Santos2, Gleison Silva Oliveira2, Sarah Alencar de Sá1, Ericks Pires do Carmo2, José Raliuson Inácio Silva2, Igor Tenório Marinho da Rocha2, Fred Augusto Louredo de Brito1, Thieres George Freire da Silva2, Felipe Alves Reis2* and Adriano do Nascimento Simões2

1Federal Rural University of the Semiarid. Street Francisco Mota, Rio Grande do Norte, Brazil

2Federal Rural University of Pernambuco/Serra Talhada Academic Unit. Av. Gregório Ferraz Nogueira, s/n, Serra Talhada, Pernambuco, Brazil

*Corresponding Author: Felipe Alves Reis, Federal Rural University of the Semiarid. Street Francisco Mota, Rio Grande do Norte, Brazil.

Received: August 06, 2024; Published: September 28, 2024

Citation: Felipe Alves Reis., et al. “Fertilization With cow Manure Promotes the Efficiency and Economic Viability of Dragon Fruit Cultivation in the Sertão of Pernambuco, Brazil". Acta Scientific Agriculture 9.4 (2025): 112-120.

Planting dragon fruit requires high financial investments, mainly in terms of fertilization. However, there is a lack of studies focusing on the financial efficiency of the crop in balance with organic fertility management. The objective of the work was to establish the relationship between organic fertilization using cattle manure and the efficiency and economic viability of planting dragon fruit in semi-arid regions. The study was carried out in an experimental area of dragon fruit fertilized with different doses of organic fertilizer (0, 5.33, 10.66, 21.33 and 49.33 kg/plant) at the Federal Rural University of Pernambuco, in the semi-arid region of the state. from Pernambuco, Brazil. Various indicators such as productivity, total revenue, average price, fixed costs, variable costs, average costs, gross margin, net margin and break-even point were evaluated. Additionally, key financial indicators like net present value, internal rate of return, profitability rate and payback time were analyzed, followed by a sensitivity analysis. The initial investment for an organic dragon fruit plantation varied mainly based on the fertilizer doses, ranging from R$44,615.93 at dose 0 to R$47,081.43 at dose 49.33 kg/plant. Short-term financial returns were not observed for doses 0.00, 5.33, 10.66 and 21.33 kg/plant. Planting was deemed efficient only at a dose of 49.33 kg/plant and with a return on investment of 3 years and 4 months. The sensitivity analysis demonstrated that the planting of organic dragon fruit is highly sensitive to changes in the price per kilo of fruit, being considered unfeasible under these conditions. The dose of 49.33 kg/plant of cattle manure was the most recommended dose for producing a pitaya plantation that is efficient and economically viable. This study marks the pioneering exploration of the impact of organic fertilizer on the economic viability of a dragon fruit plantation.

Keywords: Organic Fertilizer; Cactaceae; Pitaya; Economic Study; Sensitivity

NPV: Net Present Value; IRR: Internal Rate of Return; PE: Break-Even Point

A projection by [21]. anticipates that by 2024, global gross revenue from dragon fruit production will total $14.73 billion. Notably, Brazil yielded 2,924 tons of dragon fruit in 2022 [10]. This production could increase by 4.40% by 2029, according to the Dragon Fruit Growth Trends and Forecast Report [21]. In the Northeast region, according to the Brazilian Institute of Geography and Statistics (IBGE) [17], reported 9.12 tons of dragon fruit production in 2017, accounting for national production. Thus, the production progress is notable, and there are challenges to overcome to produce more with high quality, financial efficiency, and guaranteed economic returns.

The adoption of organic production systems are critical in promoting economic sustainability, with potential to drive social and environmental advancements within local rural properties [11]. Using chemical fertilizers, synthetic pesticides, and other external inputs has gradually contributed to the advancement of climate change impacts, soil degradation, food insecurity, and natural resource depletion [12]. Therefore, it is necessary to adopt sustainable agricultural practices that ensure more efficient production both in nutritional value and financial returns.

Several studies have already demonstrated the relationship between fertilization with natural sources and the economic sustainability of crops, indicating even the ideal doses and combinations of organic fertilizers that enhance yields, net income, and maximum economic efficiency of crops [2,18,32,33]. However, for dragon fruit cultivation in semi-arid regions, which responds well to natural fertilizer sources [16]. Nevertheless, there remains a knowledge gap concerning organic production´s impact on economic viability for dragon fruit producers in semi-arid regions, despite the surge in demand for this fruit. It is evident that, with appropriate fertilization, productivity yields will increase, and economic benefits are expected.

Against this backdrop, this study aims to explore the association between organic cow manure fertilization and dragon fruit cultivation's efficiency and economic viability in semi-arid regions.

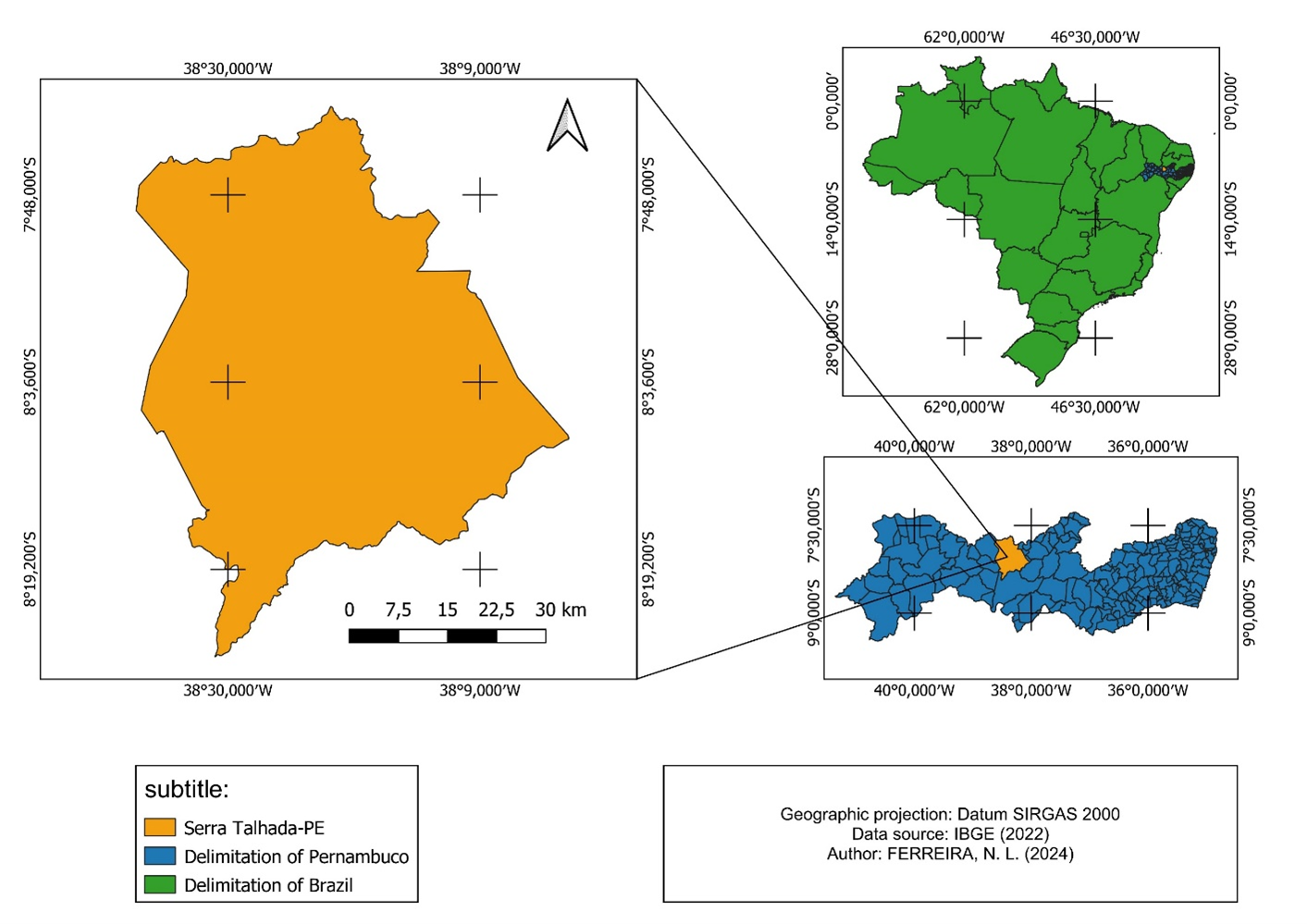

This study was developed from an experiment conducted in the experimental red pitahaya orchard (Hylocereus polyrhizus) of the Serra Talhada Academic Unit (UAST) belonging to the Federal Rural University of Pernambuco (UFRPE), Pernambuco, Brazil (Figure 1).

Figure 1: Map showing the location of the town of Serra Talhada, PE. Author: Ferreira, N. L (2024).

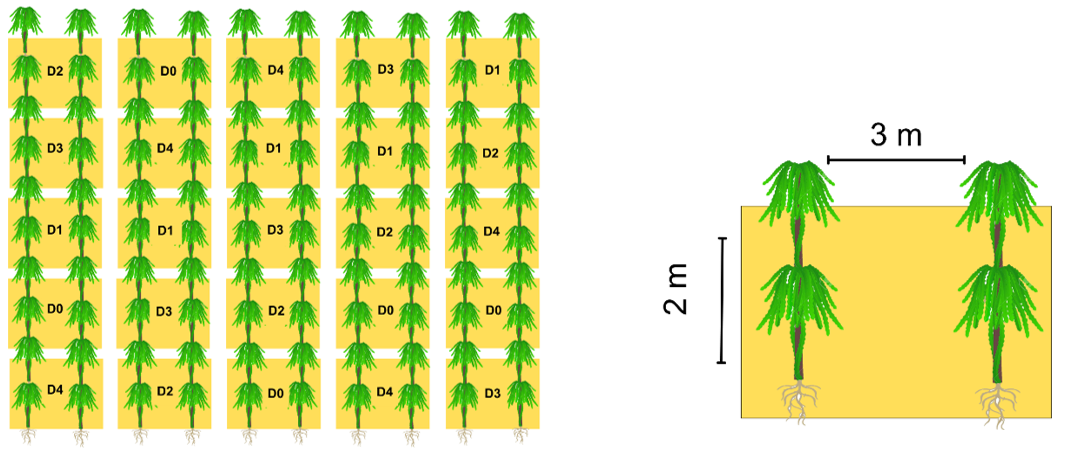

The experiment consisted of evaluating five different doses of organic fertilizer for growing red pitahaya in the soil and climatic conditions of the Brazilian semi-arid region. The doses included: dose 0 (0.00 kg of cattle manure/plant), dose 1 (5.33 kg of cattle manure/plant), dose 2 (10.66 kg of cattle manure/plant), dose 3 (21.33 kg of cattle manure/plant) and dose 4 (49.33 kg of cattle manure/plant). The study employed a randomized block design comprising 25 plots, hosting a total of 100 plants spread over 600m2 (Figure 2).

Figure 2: Experimental layout of the pitahaya field with the distribution of treatments. Source: Santos (2024).

According to the Kӧ¨ppen classification, the region has a BSw'h' climate, characterized as hot and dry semi-arid. It is located at an altitude of 435 m, with an average annual temperature exceeding 25°C, average global radiation of 17.74 MJ/m, average relative humidity of 64.85%, and average annual rainfall recorded at 653 mm [7].

In this work, we utilized on a deterministic budgeting approach, which does not involve probabilistic estimations regarding achieving specific outcomes. This methodology overlooks medium to long- term risks [5]. Then, we assumed five possible risk scenarios through the stochastic budget methodology, which is recommended to deal with the randomness and uncertainty of dragon fruit cultivation [24].

Initially, we researched the prices for all the materials, machinery, inputs, and services needed to set up an organic dragon fruit plantation, considering everything from soil preparation to the final productivity of the plantation, based on the average productivity of the experiment over three years. Informal interviews were also conducted with local fruit producers in the study region to learn about price, productivity, and other relevant characteristics specific to local cultivation.

We considered a 1.5% tax for losses and returns of goods, 5% depreciation for all machinery, and 20% for the 'pro-labore' applied by the National Institute of Social Security (INSS) according to decree no. 3,048/99 [8]. The opportunity cost of capital considered data already collected by [23] in his research with dragon fruit producers in Pernambuco and the opportunity cost of land on the value of 1 hectare of land in the state of Pernambuco. A profit tax of 27.5% according to Law No. 13,149 of 21 July 2015 [9].

The productivity of the cultivation was assessed using data already collected from the experimental area in years 1 (2021/2022) and 2 (2022/2023) of the system's installation. Year 3 (2024/2025), was designated as the period when dragon fruit production stabilizes. We estimated productivity from the previous year's data and extrapolated all values to 1 hectare. We calculated the total revenue by multiplying the kilograms of fruit produced by the average price of R$22.00 per kg established for this study. Based on the typical pricing that local producers utilize, the average price is R$22.00, which ranges from R$15.00 per kg during periods of high fruit availability to R$29.00 per kg during lower supply.

The total fixed and variable costs are considered the costs of system installation, charges, labor costs, equipment depreciation, and system upkeep. The total cost represents the variance between of the total fixed and variable costs. The gross margin is the difference between the total revenue and the total variable costs, while the net margin is the difference between the total revenue and the total costs. Profitability is determined by dividing the net margin by total revenue, and the break-even point (%) is the division of the average fixed cost by subtracting the sales price from the average variable cost. To obtain the break-even point in kg of production, we multiply the break-even point in percentage with the system's annual productivity.

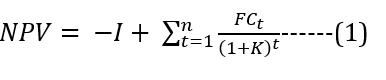

To calculate the NPV (net present value), which determines the value of the cash flow at the present date, we used equation (1) below

Where: -I = capital investment at date zero;

𝐹𝐶𝑡 = return at date t of the cash flow; n = project analysis period;

K = discount rate or minimum rate of attractiveness.

Making NPV= 0 in equation (1) gives the internal rate of return (IRR) in equation (2);

Profitability is the product of the division between total profit and total revenue, and finally, payback time represents the time needed to recover the capital invested.

We established five possible scenarios for the sensitivity analysis based on the most economically viable fertilizer dose. According to [31], sensitivity analysis is a way of projecting possible scenarios that can contextualize an actual situation, considering variations in the crop's production, price, and marketing. For this analysis, we considered the NPV, break-even point, and payback time indicators according to the following scenarios

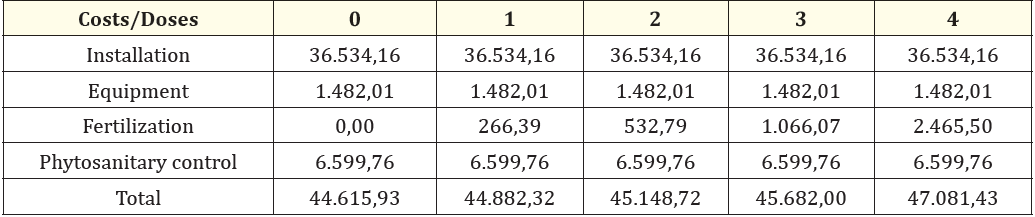

The costs of planting pitahaya in year 0, i.e., establishing the seedlings and initial management, varied according to the dose of organic fertilizer applied (Table 1). While installation, equipment, and phytosanitary control were constant regardless of the dose, adding organic fertilizer generated additional costs for planting, albeit only 2% when fertilizing at a dose of 49.33 kg/plant.

Table 1: Operating costs of a 1 ha plantation of red pitahaya with different doses of organic fertilizer, 0 (0.00 kg of cattle manure/plant), 1 (5.33 kg of cattle manure/plant), 2 (10.66 kg of cattle manure/plant), 3 (21.33 kg of cattle manure/plant) and 4 (49.33 kg of cattle manure/plant).

It is because producers can access organic fertilizer sources, such as cattle manure, which is often available on the property or supplied through partnerships between producers. On the market, a kilo of tanned cattle manure is worth pennies. However, chemical fertilizers cost up to 23% more in a conventional production system than in an organic system [4].

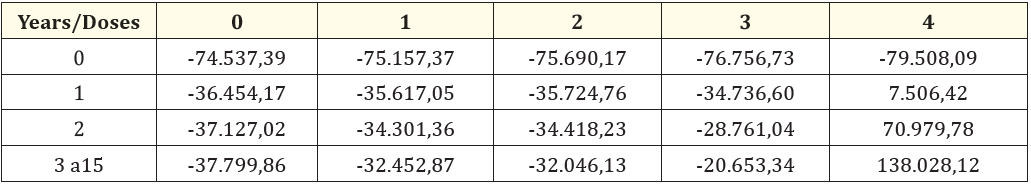

Although the costs of setting up and maintaining the pitahaya plantation in year 0 varied only as a result of fertilization, when analyzing the income statement up to the 15th year of planting (Table 2), when the pitahaya reaches its maximum useful life, negative cash flows can be seen for all doses of fertilization, with a profit only at the dose of 49.33 kg/plant, already in year 1 of production and with a noticeable increase in subsequent cash flows. Cash flows are reliable indicators of the financial situation of a commercial system [15].

Table 2: Income statement for a red pitahaya plantation under different fertilizer doses from year 0 to 15 of production. 0 (0.00 kg of cattle manure/plant), 1 (5.33 kg of cattle manure/plant), 2 (10.66 kg of cattle manure/plant), 3 (21.33 kg of cattle manure/plant) and 4 (49.33 kg of cattle manure/plant).

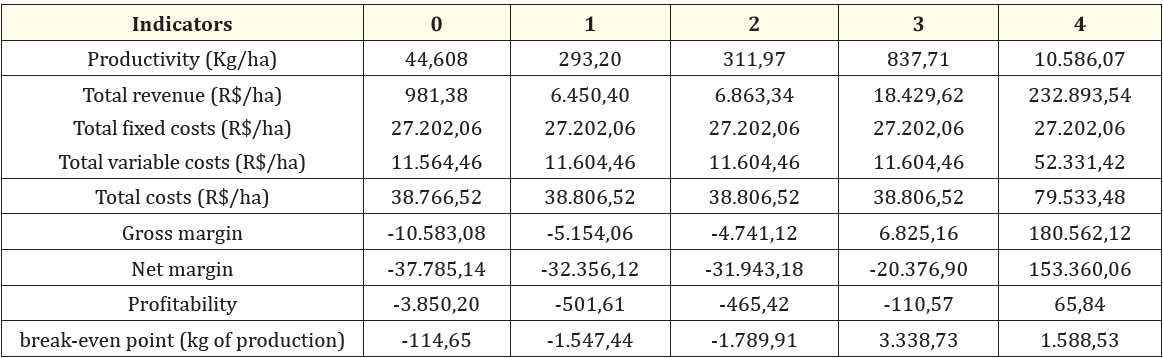

Adequate organic fertilization plays a crucial role in enhancing fruit production, resulting in higher yields and improved economic efficiency [3]. With an increase in the dose of organic fertilizer in the pitahaya plantation, productivity tends to increase and, subsequently leading to an increase in total revenue (Table 3), which, according to [25] underscores the advantages of adopting organic practices in pitahaya production. Fixed and variable costs are independent of productivity, considering management, equipment, interest, taxes, and other factors inherent to pitahaya production, which also interfere with total costs and can lead to negative profitability.

When the gross margin, equivalent to the return after subtracting variable costs from gross revenue, and the net margin, related to the result after deducting all production costs, are more significant than zero, the system is paying for itself and will survive.

However, only the plantation fertilized with 49.33 kg/plant showed a gross and net margin greater than zero, demonstrating that with this dose alone, the plantation would be economically efficient and thus pay for itself in the long term, showing 65.84 % profitability. With only 1,588.53 kg of fruit produced, the gross revenue would equal the system's maintenance costs in year 3, around 15% of production, thus breaking even (Table 3).

Table 3: Economic efficiency indicators for a 1 ha red pitahaya plantation with different doses of organic fertilizer in the third year of production. 0 (0.00 kg of cattle manure/plant), 1 (5.33 kg of cattle manure/plant), 2 (10.66 kg of cattle manure/plant), 3 (21.33 kg of cattle manure/plant) and 4 (49.33 kg of cattle manure/plant).

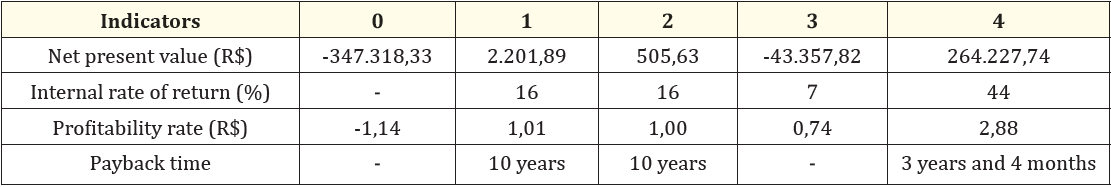

Furthermore, the NPV of each system based on fertilizer doses revealed unfavorable results for the 0 and 21.33 kg/plant doses of organic fertilizer. In contrast, 5.33, 10.66, and 49.33 kg/plant doses of organic fertilizer were positive, demonstrating the viability and profitability of the business [34]. However, the IRR is higher when using the maximum dose of 49.33 kg/plant of organic fertilizer for growing pitahaya, around 44%, which makes the NPV of the investment analyzed equal to zero [19]. In addition, the producer would get a return of 2.88 R$ for every 1.00 R$ invested. Pitahaya plantations fertilized with doses of 5.33 and 10.66 kg/plant require approximately a decade to payback the initial investment, while with the dose of 49.33 kg/plant, the payback time would be just three years and four months (Table 4).

Table 4: Economic viability of a 1-ha plantation of red pitahaya with different doses of organic fertilizer. 0 (0.00 kg of cattle manure/plant), 1 (5.33 kg of cattle manure/plant), 2 (10.66 kg of cattle manure/plant), 3 (21.33 kg of cattle manure/plant) and 4 (49.33 kg of cattle manure/plant).

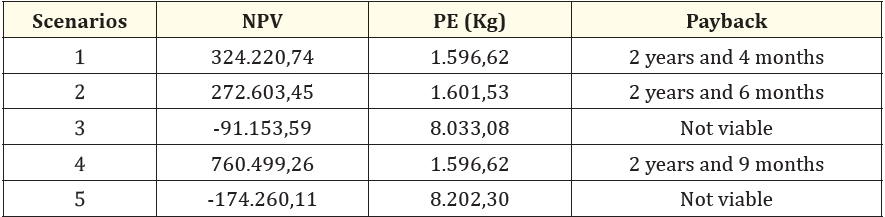

However, when carrying out a study that identifies financial efficiency and economic viability indicators, one must bear in mind the absence of risks related to planting. It makes it necessary to assess unforeseen factors, considering more significant uncertainties and investment risks [6]. According to [26], it is essential to consider heterogeneity when analyzing company profits and cash flows. In this sense, and considering the dose of 49.33 kg/plant of organic fertilizer as the most efficient and economically viable, we evaluated five scenarios to determine the sensitivity of this planting to possible risks associated with production (Table 5).

Table 5: Sensitivity analysis of a 1 ha red pitahaya plantation under different scenarios. NPV: net present value; PE: break-even point.

The initial investment for a pitahaya plantation poses a significant challenge, especially for small producers. If the farmer has stakes on his property, the initial implementation cost will be reduced [13] by up to 10.58%. Many producers, especially family farmers, leverage existing resources like Algaroba (Prosopis juliflora), Angico (Anadenanthera macrocarpa (Benth.) Brenan.), and other trees that are usually found in the vicinity of their properties, making installation easier and reducing costs [27]. In a cost-effective scenario, the producer could achieve an NPV of 324,220.74 R$, a break-even point of 1,596.62 kg/ha, witnessing a return on investment of 2 years and four months (scenario 1). However, even with the higher investment using masonry piles, around R$126,441.17, and five months longer for the return on investment (scenario 4), the producer would achieve an NPV of R$760,499.26 with the same break-even point. In addition to not causing losses to the producer, the initial cost of this type of support is an input with a useful life of 15 to 20 years [22].

A 10 percent reduction in productivity likely influenced by climate change, would not impede the economic viability of the plantation, albeit with a lower NPV (272,603.45 R$), a higher PE (1,601.53 kg/ha), and a return on the initial investment in 2 years and six months (scenario 2). This scenario would be possible mainly due to climate change, one of the main factors interfering with pitahaya fruit production and increasing the vulnerability of agricultural businesses [1,34], in a study on the financial viability of an irrigation system in tomato production in Egypt, observed that the reduction in productivity and cost increase do not affect the system's financial viability.

However, the project becomes unviable when the fruit's price decreases, reflected in the gross revenue from commercialization. Shallow sales values can result in negative NPVs rendering the production system unviable [3,28]. We observed this result when analyzing a scenario with a 77% price reduction (scenario 3), the prospect of reduced productivity and price, and an increase in costs (scenario 5).

This study marks a pioneering exploration of the interplay between organic fertilizer and the financial viability of planting pitahaya in a semi-arid climate. Under the conditions studied, the dose of 49.33 kg/plant of organic fertilizer emerged as an economically efficient and financially viable, offering a quicker return on investment in less time and at lower costs compared to conventional fertilization.

The sensitivity analysis sheds light on the volatility surrounding economic viability in possible scenarios. This work is the first study to show that pitahaya production is sensitive to price fluctuations influenced by abundant fruit at specific production times, leading producers to significantly reduce the value of a kilo of pitahaya. However, this phenomenon underscores the need for in-depth investigation, as the reduced price of a kilo of fruit is advantageous for the consumer but means losses for the producer, who may not maintain production. This pricing pattern may be indicative of producers in the Pajeú region of Pernambuco, given that pitahaya production is nascent in the region and that producers lack specialized support for optimizing their plantation´s financial infrastructure.

An alternative avenue for enhancing production outlets, financial returns, and operational efficiency could involve fostering collaborations among local producers through associations or cooperatives, as well as forging partnerships with municipal bodies and governmental departments.

This study sets the stage for future research endeavors focused on the financial dynamics of organic pitahaya cultivation in semi-arid environments, providing a foundation for further exploration and insights into this emerging agricultural sector

The authors express their gratitude the Institutions Universidade Federal Rural do Semi-arid and the Universidade Federal Rural do Pernambuco for the space allocated for the research, the Postgraduate Programs in Phytotechnics and Plant Production of the institutions mentioned above and the research groups NEFP and GAS for their support during the research.

The authors declare no conflicts of interest.

Copyright: © 2025 Felipe Alves Reis., et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

ff

© 2024 Acta Scientific, All rights reserved.